Digital Loss Prevention Capability Building - Retailer Case Study Series

Categories:

Written by:

Colin Peacock

Building E-Commerce Loss Prevention Capability: Key Takeaways from Our Latest Retailer Case Study

E-commerce has seen a rapid growth and expansion, particularly through the lockdown. In the rush to support this change in the way shoppers make their purchases, traditional bricks-and-mortar retailers had to pivot quickly to the online space. However, this shift came with a new set of challenges, particularly in loss prevention.

In a continuation of our series on ecommerce loss prevention capability building, we recently extended an invite to an e-Commerce loss leader from a leading UK pet speciality retailer, to share her how she is building capability to address the challenges associated with the “dark” side of ecommerce, including payments fraud, chargebacks, goods lost in transit and returns fraud.

One of the first hurdles she tackled was fraud. With her background in the insurance world, she was quick to identify and address the "low hanging fruit" of malicious activities, such as stolen credit card usage and misdirected deliveries. These short-term wins helped her win the confidence of the business and opened the door for her to start to address more forms of losses.

To embed loss prevention thinking in her business, she secured a seat at the table where all future projects were being discussed, and from the start, ensured that projects were designed with loss prevention in mind.

To further embed the capability she introduced a simple four question yes/no checklist. If the stakeholder answered with a 'yes', it was a cue for them to consult the e-commerce loss team. This not only expanded her circle of influence but also ensured that potential risks were identified and addressed early on.

In my catch up call with Professor Adrian Beck we reflected on the meeting and discussed the need for retailers to strike a balance between risk and customer experience. Too many controls and a low appetite for risk will hurt sales, while too few controls and a high appetite for risk can grow sales but increase the losses to payments fraud, chargebacks and goods lost in transit.

In the next months, we will continue our "learning from doing" series and hear from other e-commerce loss leaders, to deepen our learning on how retailers are building digital loss prevention capabilities and their multiple lines of defence against profit erosion.

You can watch the full discussion I had with Adrian Beck below, or read the full transcript further below. If you are a retailer and would like a recording of the full 90 minute session, including the retailer discussion that followed the presentation, please email Colin - colin@ecrloss.com

TRANSCRIPT

Colin Peacock:

Good morning, Adrian, how are you?

Professor Adrian Beck:

Morning, Colin. Yes, very well.

Colin Peacock:

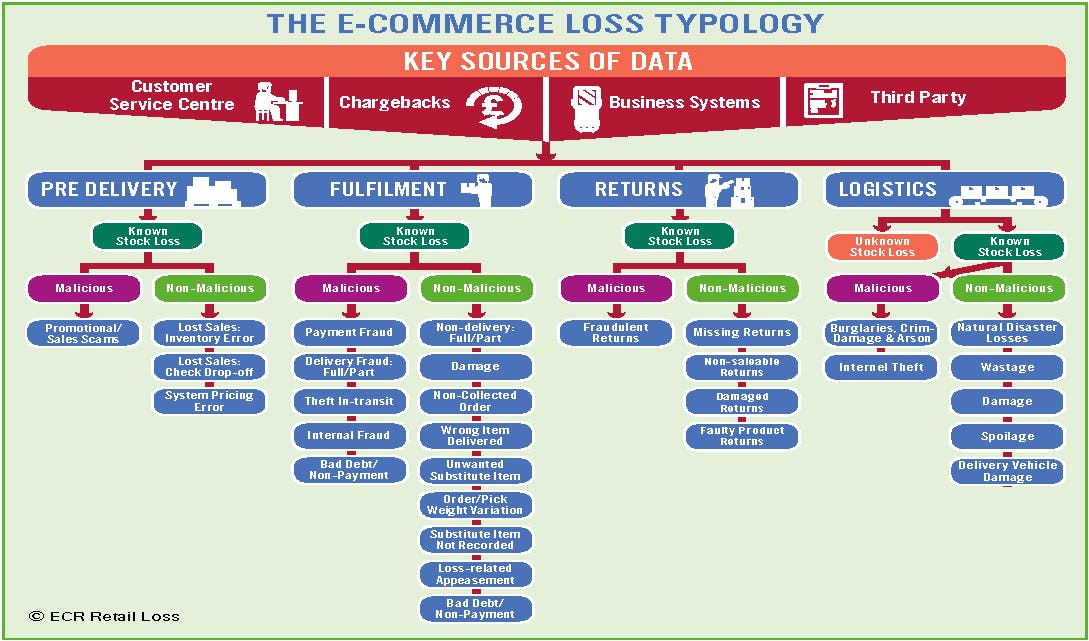

Good, good. Hey, look. A week ago, I think we had one of our working group meetings on E commerce loss. This is our perhaps newest working group and we've done with you some great research around the typology of E commerce loss.

We've also spent time looking at use cases, and then we then dip into an organisation and get their leader to tell us how they're shaping their response to the E commerce loss problem, what their KPIs are, what the skill sets they're building, what's the progress they're making, how are they prioritising, what successes are they having?

And we had a great example of an ecommerce leader - ecommerce loss leader, I should say.

And she presented what she had been doing at her business.

Actually she came from outside of loss prevention and came from the insurance world. And I thought it was a fascinating glimpse and look under the hood at how one retailer was dealing with the commerce losses.

I just wanted to know what your takeaways were and what the learnings are for other retailers who couldn't make the session.

Professor Adrian Beck:

Yes, it's very generous of these companies to share their experiences around this because broadly speaking, of course, E commerce is relatively new.

We've been around for a while, but actually for a lot of companies, it's relatively new.

They were very much based around bricks and mortar weren't they?

And then they decided to begin to join the online revolution and start offering their services and goods online for people to order.

And then of course, that was rapidly speeded up through the pandemic when a lot of physical stores just suddenly couldn’t open. So a lot of retailers just threw themselves online because it's the only way to survive was to join that community of people offering their goods online.

And we’ve really seen a lot of companies playing catch up, haven't we in terms of loss prevention.

Because it is relatively new for the loss prevention industry as well to understand the risk landscape associated with E commerce.

So I think what we saw was a classic case study with this retailer, which is they've gone online, they clearly found an audience for their goods online. But their systems weren't simply ready to manage the risks that are associated with online.

And we’ve done our work to understand what the typology to understand what the risk landscape looks like, but I think companies are now beginning to catch up and begin to start plugging the holes in terms of where they were experiencing losses.

So this was a great case study where the first place you start with losses around is fraud.

People maliciously using stolen credit cards or using different addresses to basically just commit fraud online because it’s so easy potentially to do that.

And she came in and she saw a lot of low hanging fruit in terms of the way that the company was operating and exposing themselves to risk from fraud that she was able to use her experience and talent to block off those fraud avenues quite quickly and with a lot of success. Really quickly turning around that business in terms of the risk from fraud.

And then we see that companies begin to mature, don't they.

OK, so we’ve fixed the some of the major fraud holes in our system. What else can we now begin to do in terms of making sure that other types of risks that we're exposed to can now begin to be managed?

And so you end up going from malicious and then beginning to move out in terms of managing some of the non malicious problems that can be associated with E commerce, like managing returns for instance and making sure that that's working well.

And so it was great to hear her journey in terms of starting from success around fraud and now seeing her team grow as they've been able to you know show the business their worth and value and being able to measure the impact they're having around improving their profit and margin from E commerce.

And now beginning to look at other ways in which they can provide value to their organisation in terms of making E commerce even more profitable.

Colin Peacock:

Yeah. I really applauded the work that she did in terms of just putting herself in front of, and getting a seat at the table at all these different committees that were looking at new projects and things that the company were looking at doing to expand their business and having a seat at the table.

And she introduced a special e-Commerce Loss questionnaire. If you answer yes to any of these questions, you'd better speak to the the e-Commerce loss team.

I thought that was really good. The way she'd integrated and expanded her circle of influence.

Professor Adrian Beck:

Yeah. Because one of the big challenges of E commerce is trying to balance risk and the customer experience, isn't it?

You want them to be able to place their orders very quickly. You want the credit check to be done seamlessly and quickly. You want the product to arrive in good time. You want it to be in good shape.

And if something goes wrong, you want them to be responded too quickly and that's obviously what all retailers want to happen. But it does expose you to risk.

Is the customer telling you the truth that it didn't arrive. Did the supply chain fall over? Did the courier not deliver it on time? Did it get damaged? There are all these things that you just don't know about.

But of course, that then opens you up to customers who may recognise that there's opportunities there for them to get goods without paying for them.

And so it's balancing that sort of risk versus reward around customer experience.

It can be difficult to manage and you need you know that's where you need your customer service teams to have good data.

You need good messaging in terms of how you're going to deal with this and that's where I think we're seeing people going on quite a journey - getting that information to a point to their customer teams and saying ‘if a customer rings up and says and the package hasn't arrived, what date have we got to begin to suggest that yes, it hasn't arrived?’

So we need to deal with that quickly.

Or, think ‘are you trying it on here’, you know? And do we need to do we need to respond in a different way.

Colin Peacock:

This is the 30th time that it hasn't arrived at that address, you know.

Professor Adrian Beck:

Yeah. And some are getting very good at that, aren't they? Where they're now beginning to build up those customer profiles and say, ‘You know, we seem to have a real problem delivering to your, to your address. It's happened on numerous occasions. Next time you put an order in, perhaps you need to come to the store and pick it up. And that that may give you a better, a better service than what we're getting at the moment.’

And so I think we've seen the way that people can use that data to help them manage their risk more effectively online.

Colin Peacock:

You know, there's that connectivity between customer service and E commerce loss and the data that's around that. I think we've got some case studies coming up early next year around some retailers who have done a lot of work in that space. And reduced goodwill payments by 20 to 30%. So that is an interesting area indeed.

Professor Adrian Beck:

Yeah.

Colin Peacock:

Well, look, thank you very much for those thoughts. It really. As you say, and no doubt, we'll have more learnings from organisations over the next years, but thank you again for the time. Cheerio. Bye.

Professor Adrian Beck:

OK. Cheers, Colin.

Oct 23, 2023

Main office

ECR Community a.s.b.l

Upcoming Meetings

Join Our Mailing List

Subscribe© 2023 ECR Retails Loss. All Rights Reserved|Privacy Policy